What To Know About High-Value Life Insurance Policies In Thailand And The USA

The Future of Life Insurance Policies

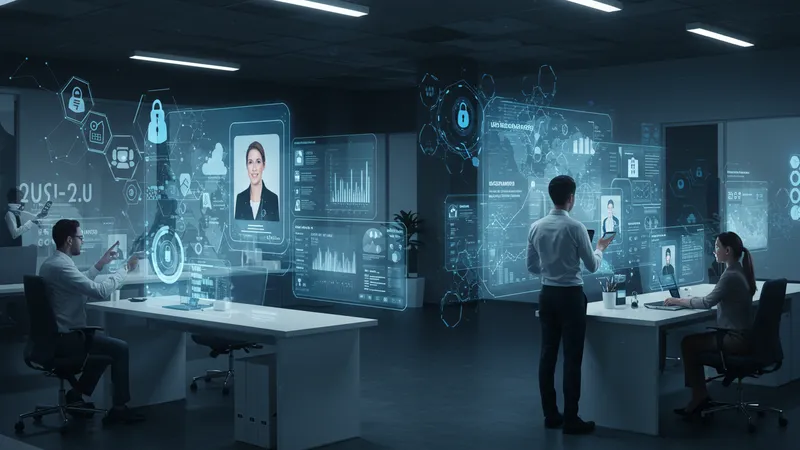

The landscape of life insurance is on the brink of revolutionary transformation. Technology and digitalization are at the forefront, streamlining application processes and customizing policies with unparalleled precision. Instant underwriting, predictive analytics, and personalized digital dashboards present a future where policies are hyper-tailored to individual needs in real-time. But what’s utterly transforming is the rise of insurtech companies challenging traditional providers.

These insurtech enterprises are rewriting the playbook, offering digital-first, customer-centric experiences. From AI-powered chatbots providing 24/7 support to blockchain technologies securing user data and transactions, the efficiency gains are undeniable. This pivot towards technology doesn’t just enhance customer experience; it significantly lowers costs, presenting a more democratized form of access to comprehensive financial products.

Adapting to this new environment is essential for both consumers and traditional insurers keen on maintaining market relevance. The expectation is towards transparent, rapid, and seamless service—a far cry from prolonged paperwork and opaque fee structures of the past. The result? A clientele that’s not only more informed but more engaged with their insurance products than ever before.

The insurance industry’s digital future isn’t just hypothetical—it’s impending and transformative. As the following sections will highlight, the coming innovations seek to redefine not only the shape of policies but also the manner in which they integrate across financial ecosystems. It’s an evolution that beckons you to reconsider the role life insurance plays in broader asset management and personal planning.